Mileage Receipt

Everlance automatically logs tax-deductible business mileage expenses receipts more. Enter the departure location in the From field and the destination location in the To.

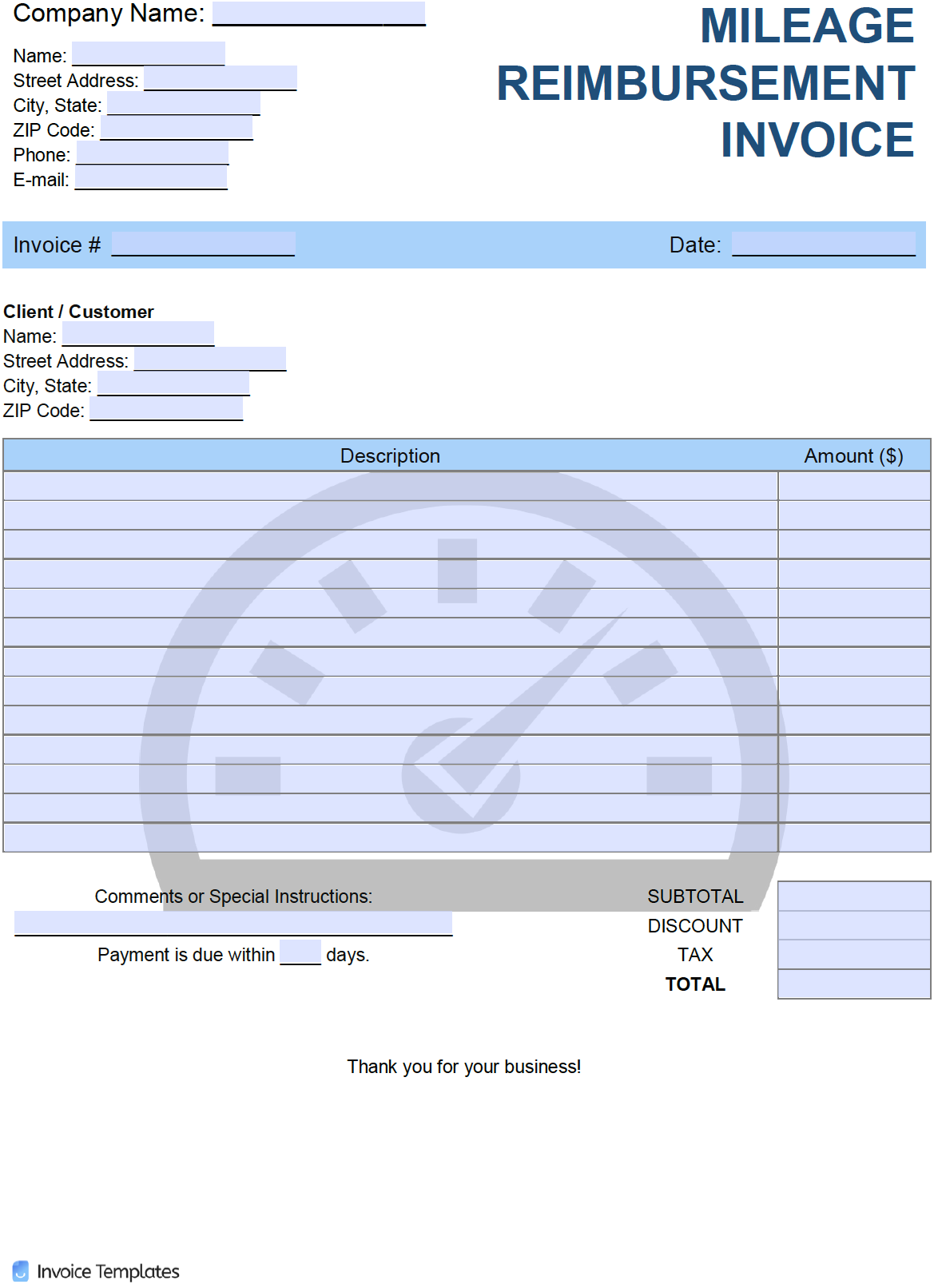

Free Mileage Reimbursement Invoice Template Pdf Word Excel

Ad Register and Subscribe Now to work on your FSAFEDS Mileage Worksheet more fillable forms.

. This included whether or not the app had automatic mileage tracking receipt upload direct reimbursement workflow management tools workflow approval. Download Mileage Receipt ExampleTemplate FREE Printable Format. Edit Sign Easily.

Ad Avoid Errors Create A Receipt Online. Log in to your SAP Concur profile and start a new report by clicking Create New Report from the Expense tab of your SAP Concur profile. 1 The Car Vehicle Receipt Is Downloadable In Three Formats.

This information can be used for. By the same token your. When a mileage expense Category is selected additional information is required.

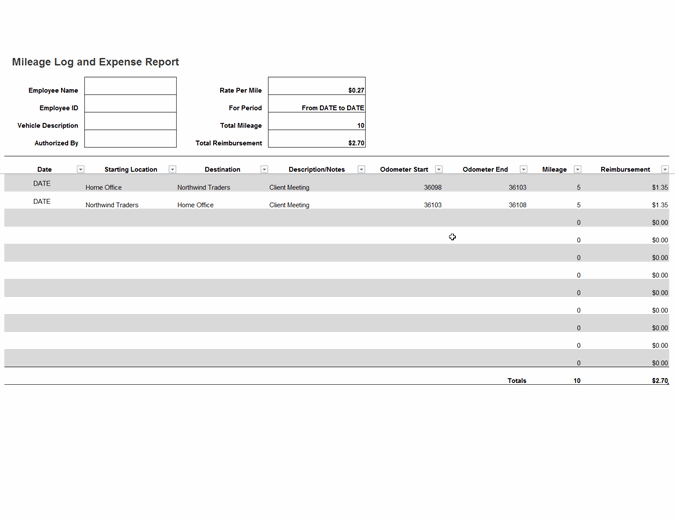

Record your odometer reading at the end of the year again this is required on Form 2106. Triplog is a mileage tracker app that helps managers make the expense reimbursement process much smoother. In 2018 the standard mileage rates increased slightly from those in 2017 for travel related to business medical or moving needs.

Ad Build a Word Compatible Receipt Today - Export and Print Start For Free. Navigate to a users expense sheet by clicking their total under the Mileage Expenses dashboard column. Your mileage log and mileage logs can lead to significant savings through the mileage deduction or as a business expense.

Click to the Open Expenses or. For Companies For Self-Employed. Here are some tips about good.

In this instance a log would be kept of the mileage used for business and multiplied by the deduction rate published by the IRS. To view individual receipts. Currently this rate is 575 for 2015.

This app provides accurate automatic mileage. With this improved feature in Expense Management companies can extract information about claimable VAT from mileage fuel receipts. 1 PDF editor e-sign platform data collection form builder solution in a single app.

You can obtain a receipt template from this page as a PDF or Word Processing document WORD and ODT. Youzign Help Webinar Login. Create Edit Print A Receipt For Word- Easy To Use Platform - Try Free Today.

625 cents per mile for business purposes. The most important thing when it comes to the actual expense method is saving receipts and logging actual mileage expenses. My mileage claim has 2 alerts for havent provided enough petrol receipts to cover vat etc however my receipts are within 2 days and are way over the.

As in the Personal Car Mileage scenario fill in. 22 cents per mile for medical and moving purposes. IRS Standard Mileage Rates from July 1 2022 to December 31 2022.

This is best done by systematically keeping a mileage log template. For business miles driven the rate is 545. A Mileage receipt design created with Youzign.

Mileage and Receipt. In 2022 the mileage rate was 585 cents per mile for January. Fill Out Print A Receipt In 5-10 Minutes.

Download Mileage Receipt Mileage-Receiptpdf Downloaded 4 times 46 KB. 339 x 480 px. Over 1M Forms Made - Try 100 Free.

Mileage Reimbursement Invoice Template Word Excel Pdf Free Download Free Pdf Books

Free Mileage Log Template Download Ionos

Creating A Mileage Expense Certify Help Center

How To Record Mileage Help Center

Mileage Reimbursement Invoice Template